Speculation: Beneficial to the Market Economy

Speculators are currently not very popular. For the globalisation sceptics from Attac speculation is to be blamed for high food prices and famines in third world countries. The German Minister for Economic Affairs, Sigmar Gabriel accuses the presently weakening Deutsche Bank to have “made speculation their business model”. Warren Buffet, himself a very successful speculator, holds a mirror up to his industry and blames his colleagues for playing with “financial weapons of mass destruction”. The image of speculation as something morally disreputable and economically damaging is very popular. Politicians are regularly asked to limit speculation through taxes and prohibitions.

Critics barely explain what exactly they regard as speculation – which is not very surprising: It is not easy to find a definition of speculative behaviour which captures the core motives of the often criticised financial markets participants, but at the same time excludes everyday behaviour based on the same motives. It seems that professional business activities which aim at creating profit from future price changes is what people have in mind here. However, those activities play a beneficial role in the market economy.

For speculation to contribute to the improvement of information provided by the pricing system and to perform its task of bundling risks, a rule structure needs to be in place that makes sure that speculators are held liable for their decisions in case of a loss. Arguing for such a framework should also be the critics aim.

A risky Bet on the Future

The German Duden defines speculation as “business activity aimed at making profits from future changes in prices”. These activities can take place in many different markets – i.e. in goods, financial or forex markets. Thus, a speculator can buy a bundle of goods expecting an imminent increase in prices. If his expectations fulfil, he can realise a profit when selling the goods. Also, betting on certain price developments, i.e. with the appropriate financial products, is a form of speculation.

In general, all activities which are regarded as beneficial by the one acting with regards to the expected future events and therefore lead to psychological or monetary profit can be labelled speculative. Since expectations about the future can turn out to be wrong, there are always risks involved with speculation. Such a broad definition of speculation includes many professional and private decisions: from the daily decision of what to wear based on the weather forecast to the participation in continuing education programmes to a private pension plan.

In current language, however, the only activities labelled speculative are undertaken in a professional manner with purposes of turning a profit, include goods that can be priced and potentially lead to monetary profits. Therefore, despite having the same underlying considerations, privately buying a gold coin is not considered speculation, while a professional financial markets bet on the price is. Buying a second pack of salad in expectation of empty vegetable shelves over the weekend is not regarded as speculation, the trading of future contracts for agricultural products on the other hand is.

No increase in Prices and Shortage through Speculation

The accusations of speculators are numerous and have a different focus varying from market to market. In goods markets, especially those for agricultural products, speculators are often accused of causing high or “distorted” prices and artificial shortages. Without speculators, according to critics, prices would be lower for customers and higher quantities of the related goods would be available. What exactly e.g. Attac regards as speculation remains unclear – however, it includes buying and selling financial products for other than forward covering or price hedging purposes. But are speculators really interested in and in the position to systematically drive prices and put downward pressure on the market supply?

It is true that the speculative buying of goods (or the entitlement to them) leads to an increase in demand and therefore a short-run price increase. The speculative act, however, is only fulfilled when the goods are sold again – otherwise the speculator would not make any profit. Through selling he contributes to the supply and therefore to a short-run price decrease. Financial instruments enable speculators to also profit from falling prices. Hence, speculators as a group do not have a common interest in higher prices. Individually, every speculator influences the price and supply and demand conditions on at least two occasions, with the effects opposing each other.

Since speculators can only make a profit if they systematically align their behaviour with future price and supply conditions and are more often right than wrong, they are contributing to less volatile price and supply conditions in the long run, which makes it easier for other market participants to plan ahead. There is no reason to assume that speculators can systematically distort prices and influence the supply conditions in the long run.

The Speculator as Insurer

The activities of insurance companies can also be regarded as speculation. Speculators who are active in several different markets at the same time, are bundling risks and take them away from other market participants. Due to their comparative advantage in accurately predicting future developments in different markets, they achieve a better risk management than is available to the individual market participants.

In the markets for agricultural goods it is common practice that producers sell the claim on their future harvests for a fixed price in advance to hedge the risk of lower prices in the future. The risk therefore lies with the buyer of this contract – usually a speculator who can diversify they risk away in his portfolio by selling other market participants the right to buy the not yet harvested goods at a fixed price.

More efficient Markets

The purpose of prices is to communicate the market participants’ needs and the resulting relative scarcity conditions. Markets with prices containing a high level of information are efficient – the prices for goods traded in those markets reflect the information and expectations of all participants.

Prices fulfill their task as information carriers better if markets are thick, which means that they consist of many market participants and transactions. Especially speculators are contributing to making markets thicker as their profits are higher the more accurate their predictions of future developments are – a valuable information they reveal to all market participants.

Market sorts out Herd Animals

But are speculators even able to increase the content of information in prices? In the context of financial crises, many critics take the view that speculators do not consider informed expectations but try to predict the behaviour of other speculators. As herding animals they would therefore cause exaggerated price corrections and booms, thus decreasing the content of information of prices. In extreme cases this herd mentality could lead to speculative bubbles when prices only increase because speculators buy and speculators only buy because prices are rising. A popular example is the US housing bubble in 2007 which led to the financial crisis when it burst.

Even if herd mentality is generally possible in markets, there is no reason to assume that it represents a profitable business model in a market economy. In an economy with individual liability predicting future developments wrong means high losses and finally the market exit for a speculator driven by herd mentality – at latest when the bubble bursts. From the point of view of the other market participants such a process is beneficial as only those speculators remain in the market whose behaviour leads to an actual increase in the amount of information included in prices.

Speculation needs Market-Economy based Frameworks

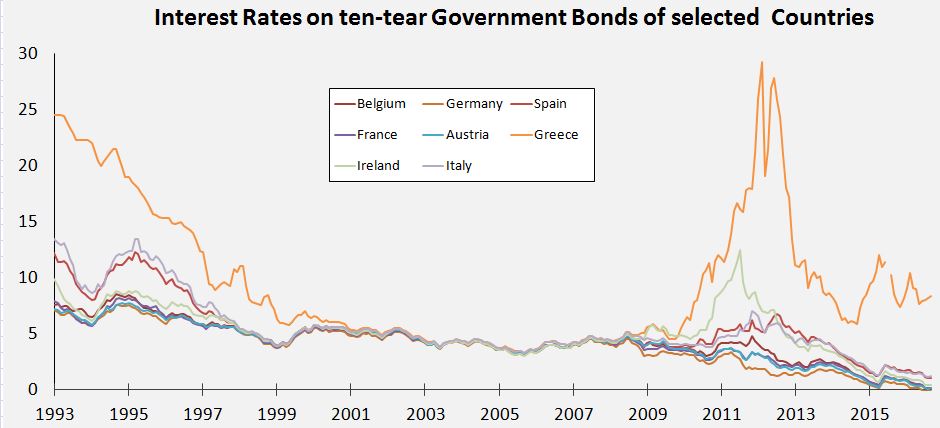

In general, herd mentality and the creation of bubbles gets punished rather than rewarded by markets. The issue can become problematic if speculators do not have to fear to be punished for their risky decisions. During the US housing bubble in 2007, individual liability was weakened by implicit and explicit state guarantees. Before the crisis real-estate speculators assumed – which turned out to be true – that in case of a loss they would get compensated by tax-money. In the eurozone, interest rates on government bonds almost completely converged – a circumstance, which shows that creditors grosso modo rightfully believed that in case of a country’s default other countries would jump in to bail it out.

In the light of previous discussions it becomes apparent that such emergency actions incur costs which are far higher than the direct costs for the tax payers. In the long run they undermine the beneficial effect of speculation on pricing and risk allocation in markets. If a framework enforcing individual liability exists, however, speculators have to exit the market if they systematically predict the future wrong.

Only those players remain, whose comparative advantage lies in accurately predicting future developments. Their pursuit of profit benefits the market economy: It contributes to less volatile price and supply levels, reduces the individually carried risks and increases the amount of information incorporated in prices.

This article is a translation of an original piece published on our German site and available at http://de.irefeurope.org/Spekulation-Segensreich-fur-die-Marktwirtschaft,a1178