Lithuania is often viewed as a success story of austerity measures. Although the country did reduce public spending, it also suffered from high budget deficits which translated into a sharp public debt growth.

Budget Deficit, Public Debt and State Social Insurance

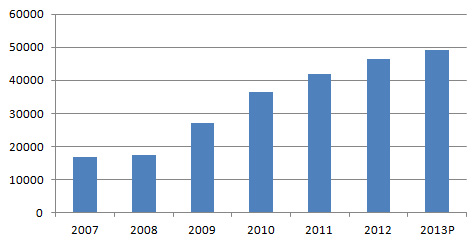

Budget deficits have been reined in from 9.4% of gross domestic product (GDP) in 2009 to 4.1% in 2012, in part thanks to a rebound in economic growth which reached 5.9% in 2011 and 3.6% in 2012. However, total public debt has grown from 16% of GDP in 2008 to 41% in 2012 and has almost tripled in absolute terms:

Lithuanian Public Debt (mln. Litas)

A growing public debt has implied growing interest payments, which have also nearly tripled from LTL 833 mil (€241 mil) to LTL 2.3 bn (€668 mil). Heating prices are a source of significant worry for most Lithuanians and it was interesting to compare this price with debt interest payments. Research shows that in 2012, public debt interest payments for a family of three equalled the heating price of an average apartment over the entire heating season. While heating prices are a topical issue every winter in Lithuania, the problem of rising interest payments has not yet been fully recognized by the general public.

Lithuanian State Social Insurance Fund has been severely strained due to pensions increases, approved before the economic crisis of 2008. In 2009, the parliament cut pensions and other benefits. However, these cuts were temporary as they lasted only 2 years and were brought back to their previous level beginning 2012. This is in line with the ruling of the Constitution Court, which indicated that any social insurance benefits’ reductions have to be temporary and compensated.

Total outstanding debt of the State Social Insurance Fund currently stands at LTL 10.1 bn (€2.9 bn) or 9% of GDP, while the interest payments in 2013 will amount to 6.6% of fund’s income. The prospects of the public pension scheme appear bleak, no comprehensive reforms are being discussed and it is unclear how the debt will be repaid.

Lithuanian State Social Insurance Fund (mln. Litas)

To make matters worse, in the past 6 years the state has undermined the only real alternative system to the public pension fund. In 2004, Lithuania introduced a private funded pension scheme (II pension pillar) that was meant to alleviate future strains on the public pension system that will arise due to unfavourable demographic tendencies. This scheme was funded by a small part of social insurance contributions. The economic crisis and the growing deficit of the State Social Insurance Fund induced the parliament to cut the contributions to the funded scheme from 5.5% in 2008 to 1.5% in 2012, slightly increasing it to 2.5% in 2013. As of 2014, the contributions rate will be 2% with an additional subsidy of 1% of the average wage given for those willing to contribute 1% of their after-tax income. In 2016 both the subsidy and the individual contribution are set to increase to 2%. The conditionality of the subsidy implies that the individuals with lowest earnings may be unable to save an adequate amount for their pension.

Personal Income Tax

Throughout 2012, the personal income tax rate remained stable at 15%. Nonetheless, there have been debates on scrapping the flat tax in favour of a progressive income tax. In November, a new centre-left wing government came into power following parliamentary elections. The government’s programme includes a position that the progressivity of the income tax should be increased, although this can be done either by abandoning the flat tax or by increasing the tax-exempt amount. It appears that the latter measure will be chosen to implement the government’s programme.

As of 2012, the minimum fixed amount of personal income tax levied on business certificates has been increased from LTL 120 to LTL 1440 (€35 and €417, respectively). Business certificates are the simplest way to pay taxes for self-employed entrepreneurs, since they enable entrepreneurs to pay fixed personal income tax, social insurance and healthcare insurance contributions prior to their activities and there are no requirements for extensive accounting. The only requirements are to give receipts to customers upon request and submit an income declaration. After the tax was raised, the number of individuals paying taxes by purchasing business certificates has dropped by 11%. During the temporary tax cut in 2012, the number of individuals grew by 27%. The following table illustrates how tax cuts spur economic activities and promote entrepreneurship.

| Personal income tax | Number of business certificates’ owners | Change from the previous year | |

| 2010 | LTL 1440/€ 417 | 67 405 | |

| 2011 | LTL 120/€ 35 | 85 641 | +27% |

| 2012 | LTL 1440/€ 417 | 76 330 | -11% |

Since the business certificates are associated with minimal administrative and tax burden, the state has often attempted to curb their use. As of 2011, individuals cannot carry out their activities under business certificates if their turnover has reached the threshold required to registers as a value added tax payer (LTL 155,000; €44,930). As of 2012, individuals cannot earn more than LTL 15,000 (€4,348) from businesses – the rest must come from person-to-person transactions.

As of 2012, individuals can donate 1 percent of their paid personal income tax to a political party of their choice. Lithuanians may also donate 2 percent of their paid personal income tax to charities, religious institutions, NGOs or public sector institutions such as kindergartens. In 2012, 411 000 individuals donated LTL 40 mil (€11.6 mil) to almost 19 000 organizations and 49 200 individuals donated LTL 2.1 mil (€0.6 mil) to political parties. The lower number of donations to political parties indicates that the Lithuanians are much less willing to support political parties and would even prefer that money is spent by the state budget.

Social Insurance Contributions

As of August 1, 2012 first-time employees have to pay full social old-age insurance contributions. Prior to this date, employers of new entrants to the labor market did not have to pay their old-age social insurance contributions (amounting to 23.3%) if the employee’s earnings were under 3 minimums wages (at the time, the minimum wage was LTL 800 or €232).

A new maximum social workplace accident insurance came into effect as of 2012. Prior to that, there were three rates – 0.18%, 0.38% and 0.9%. Afterwards, a new rate of 1.8% was introduced for the riskiest employers and the rate for third riskiest employers was raised from 0.38% to 0.42%.

Healthcare Insurance Contributions

Healthcare insurance contributions for regular employees remained stable throughout 2012. Healthcare insurance contributions paid by self-employed individuals are fixed at 9% of the minimum wage. The minimum wage was raised twice in 2012: first from LTL 800 (€232) to LTL 850 (€246) as of August 1, 2012 and then to LTL 1000 (€290) as of 2013. This means that the healthcare insurance contributions for self-employed entrepreneurs have increased from LTL 72 (€21) per month for LTL 90 (€26), which is a raise of 25%.

Guarantee Fund Contributions

Guarantee Fund provides payments to employees of bankrupt companies and is financed through current employees’ contributions. As of 2012, the contributions rate was doubled from 0.1% to 0.2% of an employee’s income.

Corporate Income Tax

Standard corporate income tax rate in Lithuania is 15%, with a reduced rate of 5% applied to small companies. Prior to 2012, the reduced rate was applied to companies with income under LTL 500,000 (€145,000) and as of 2012 the threshold has been doubled to LTL 1 mil (€290,000). This has allowed more companies to apply the reduced rate and therefore lowered the tax burden on businesses.

Value Added Tax

As of 2012, the threshold to register as VAT payer has been increased from LTL 100,000 (€29,000) to LTL 155,000 (€44,930). This move will reduce the tax burden on small businesses, therefore improving business conditions in Lithuania. However, there is still room to raise this threshold since the maximum threshold legislated by the European Union stands at LTL 345,000 (€100,000).

At the end of 2012, the parliament amended the Law on Value Added Tax and extended the use of VAT reduced rates. Reduced rate of 9% applied to heat energy, hot and cold water was set to expire in the end of 2012 and the parliament extended it to the end of 2013. Deadline for applying a reduced rate on medicine and other medical services compensated by the state was also extended from the end of 2012 to the end of 2013. Similar laws have been passed for a number of years, each year extending the use of the reduced rate on heating and medicine for an extra year.

In 2012 a reduced VAT rate on hotel and special housing services expired. The reduced rate was in effect only throughout 2011. Interest groups have been advocating a reintroduction of the provision, claiming the reduced rate would allow hotels to invest and thus attract more visitors to Lithuania. It is yet unclear whether the provision will be brought back into law.

Excise Duties

Most of the excise duty rates remained stable throughout 2012, with the exception of excise duty on intermediate products with alcohol concentration under 15% which was raised from LTL 198 (€57) to LTL 216 (€63) per hectoliter.

Residential Property Tax

After a decade of debates whether Lithuania needs a residential property tax, a poorly prepared law introducing the tax was hastily passed in late 2011. Total time of draft law hearings and voting in the parliamentary session amounted to less than an hour. A tax of 1% is applied on total family-owned property valued above LTL 1 mil (€290,000). Revenues of the commercial property tax go to municipality budgets, yet revenues of the new residential property tax go into the coffers of the state budget. This means that these revenues will not be used to improve the local roads or finance other local services, as is typically the case with residential property taxes.

When the new tax was introduced, the parliament expected its revenues to total LTL 17 mil (€4.9 mil) or 0.1% of state budget tax revenues. Many potential taxpayers tried to avoid this tax by giving away a part of their property to adult family members, decreasing the official property value or using legal loopholes in the law. Actual revenues amounted to only LTL 3.8 mil (€1.1 mil), or just 23% of the official forecast. This means that the residential property tax is inefficient, since it brings in low revenues yet produces an administrative burden both to the taxpayers and to the tax administrator. Even though this tax can be viewed as a failure and should be abolished, there are calls from some politicians to lower the tax-exempt threshold or even make it a universal tax.

Land Tax

In late 2011, the parliament passed a law changing the land tax from a fixed rate of 1.5% to introducing a bracket of 0.01-4%. The parliament gave the power to the municipalities to set the exact land tax rate, depending on the use of land and other criteria. The law also changed the value-setting method: prior to this the tax was levied on old calculations of land value, while the new law stipulates the tax will be paid according to a “market” value of the land.

The changes have come into effect as of 2013 and many landowners have seen drastic increases in their taxes, sometimes by more than 100 times. Some municipalities have set a 4% tax rate on “unused” land, which is a big issue for landowners since their land may be unused due to poor market conditions or prolonged bureaucratic procedures in obtaining building permits. A draft law has been registered in the parliament in early 2013 to postpone this law, which would allow the taxpayers to better adapt to the increased tax burden.

Tax on Natural Resources

As of 2012, the tax on natural resources was raised by 10 – 323%. The lowest tax increase was on clay and the highest tax increase – on turf (from LTL 0.62/m³ to LTL 2/m³ € 0.18/m³ and € 0.58/m³, respectively).

Future Prospects

In early 2013, the newly-appointed center-left wing government formed a Tax Commission to oversee a potential tax reform. The commission consists of government officials as well as market representatives, auditors and tax policy experts.Key issues on which the commission should decide are progressive income tax, reduced VAT rates and residential property tax. The most likely outcome of the commission is to keep the flat tax and instead to raise the tax-exempt amount. It is also likely no reduced VAT rates will be introduced. There is a danger that the commission will propose an introduction of a proper capital gains tax and a universal residential property tax. Therefore, it is likely that further tax discussions and decisions will focus on lowering the tax burden on labor and raising it on wealth and capital.

Kaetana Leontjeva

Lithuanian Free Market Institute, Vilnius

http://www.freema.org/