Wealth taxes have played a minor role in the tax systems of the OECD bloc: they have declined from about 7.9% of total tax revenues in the mid-1960s to about 5.5% in the late 1970s and remained more or less stable during the recent decades.

This trend is somewhat puzzling. There is no doubt that wealth mirrors taxpayers’ ability to pay better than income or consumption and that redistributive policies should perhaps target increasing inequality in wealth rather than income. Yet, policy-makers have hesitated to move taxation towards wealth. Could it be because they fear fierce opposition from their voters?

A recent research project funded by IREF and the University of Napoli “Federico II” investigates whether this hypothesis is indeed correct by surveying a representative sample of Italian households. Quite unexpectedly, the evidence does not support the conjecture: Italians prefer wealth to consumption taxes and this preference is at par with income taxation. In particular, a unique tax on wealth that replaces all other forms of taxation is by far perceived as the best choice, and is most popular among those who believe that fairness calls for low tax pressure. In fact, people oppose wealth taxes when they fear that such taxes are introduced on top of those already existing, but opposition disappears when wealth taxes come in substitution of other forms of taxation, provided they do not target the main residence, which constitutes the principal asset for most Italian households.

Attitudes towards wealth taxation

To assess the attitudes towards wealth taxes, the survey asked people three different questions regarding their preferred source of tax revenues at large, their attitude towards the possibility that a unique tax, possibly on wealth, replaces all the other taxes, and their willingness to finance an increase in public expenditure with taxes on wealth, given different types of public expenditure that the additional tax revenues would finance and the government in charge of managing resources.

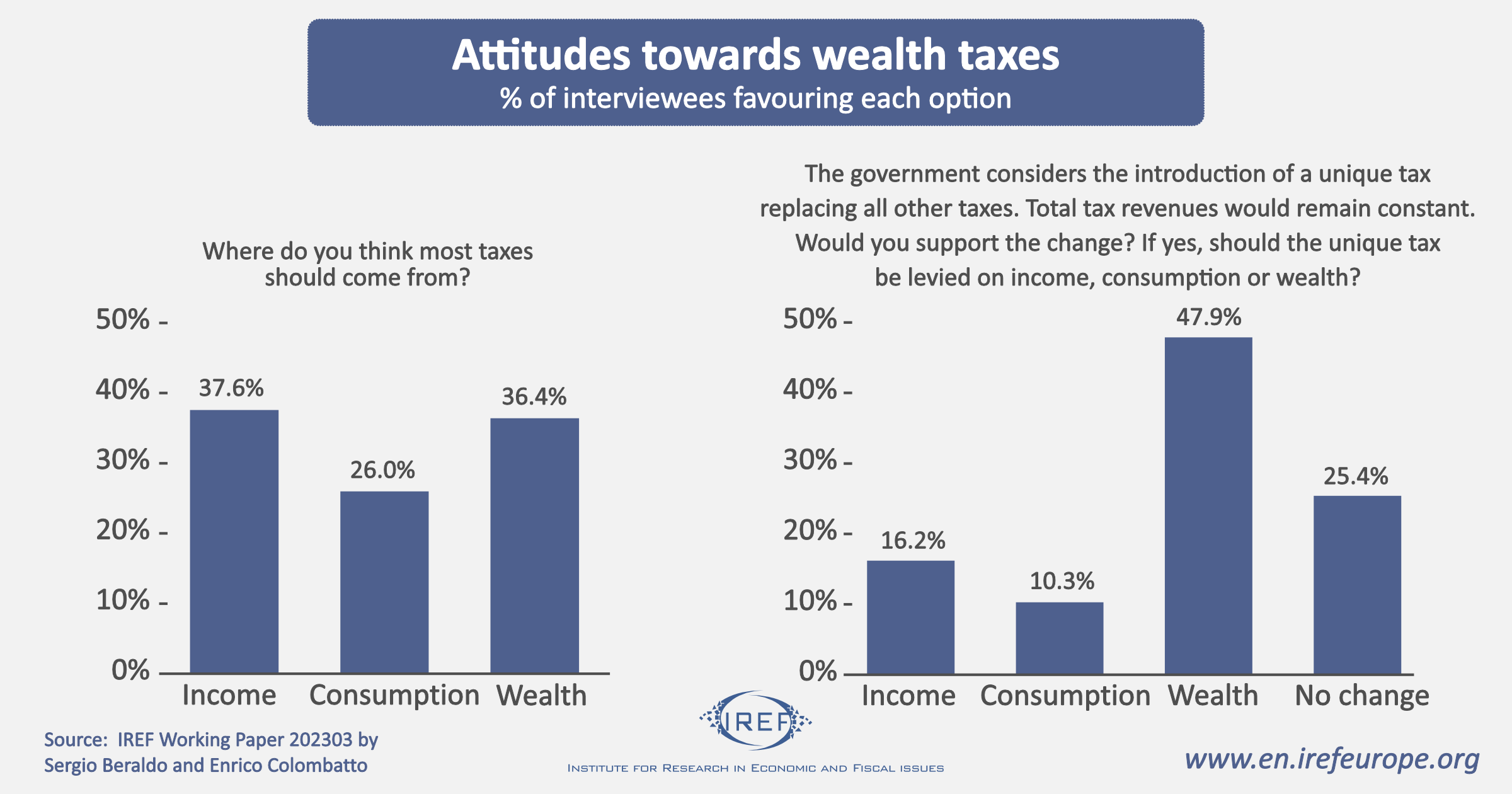

In general, the share of those in favour of taxing wealth is significant. As Fig. 1 shows, more than one third of the interviewees believe that wealth should be the prevailing tax base. This share rises to almost 48% when individuals are asked which tax they would use to replace all the other taxes.

Fig. 1

Similarly, almost half of the sample is willing to accept a tax on real estate or on bank deposits to finance a permanent increase in public spending.

Values, beliefs and political inclinations

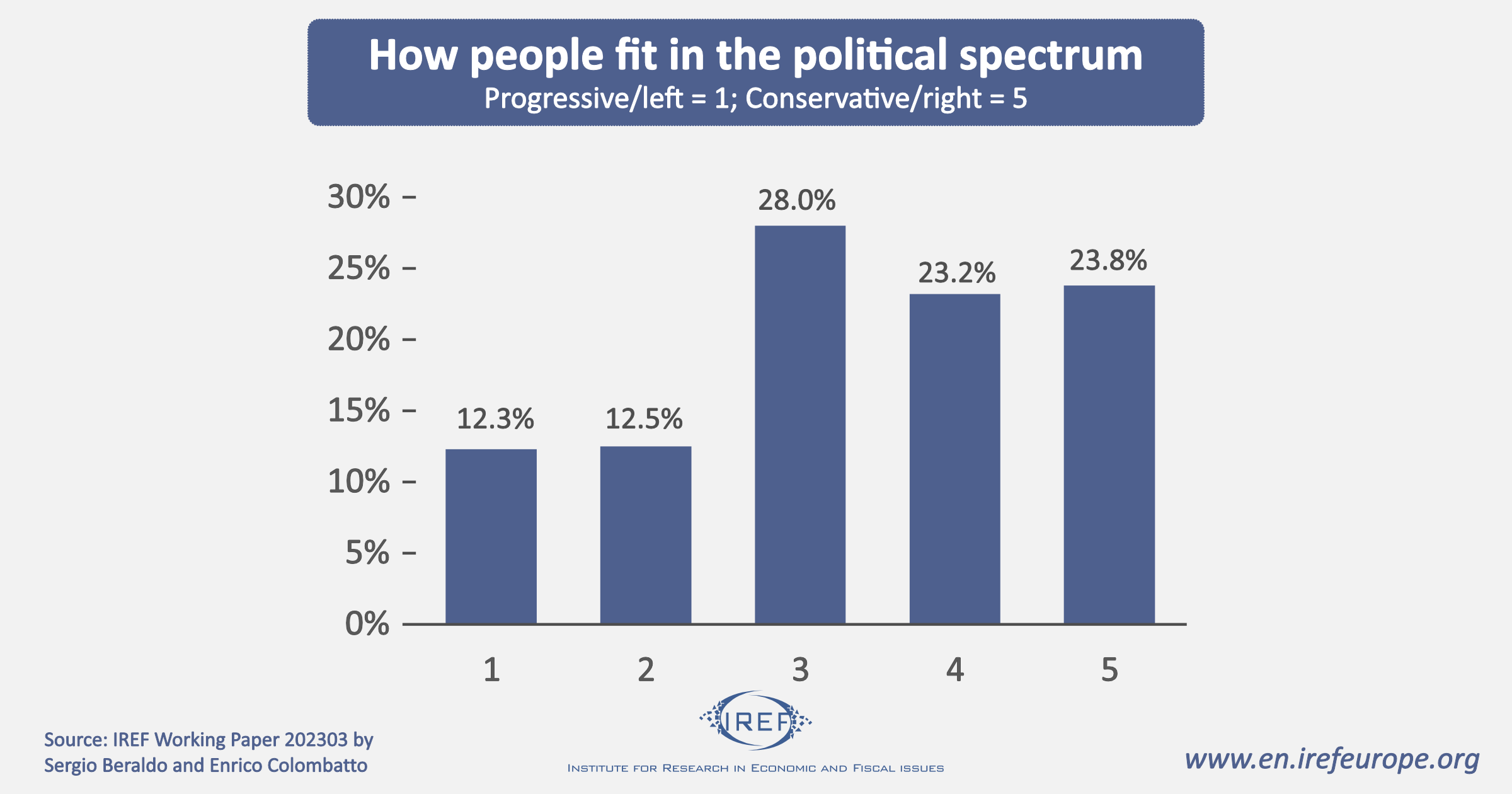

In regard to the motivations behind the support for wealth taxation, the interviewees were asked where they fit in the political spectrum on a scale from 1 (Progressive/Left) to 5 (Conservative/Right). The interviewers made clear what these labels commonly mean. In particular, it was emphasized that the progressives advocate income and wealth equality, to be obtained by resorting to taxation and public expenditure. By contrast, the conservatives aim at preserving individual liberty and oppose heavy government interference (moderate taxation and limited public expenditure).

Figure 2 shows that the distribution of preferences is skewed to the right: as one moves from the left to the right of the political spectrum, support for a unique wealth tax increases. Further statistical investigation (not reported here) also shows that beliefs about the ideal/fair tax pressure are negatively correlated with the preference for wealth taxation: when the ideal tax pressure gets smaller, support for a unique wealth tax increases. In this regard, the percentage of individuals considering a given tax pressure as fair increases as the tax pressure drops, independently of one’s political views. The current narrative, according to which the leftists support high tax pressure is thus rejected.

Fig. 2

As far as individuals’ values and beliefs are concerned, it is interesting to observe that the probability of supporting a unique tax on wealth is lower among those who believe that success is related to effort. One could argue that wealth is generally seen as a measure of success: people who believe that economic success is due to talent, efforts and the willingness to accept sacrifices have no feelings against being rich. Hence, they are more likely to object to wealth taxation. The survey also shows that self-interest matters: as one’s self-assessed economic status improves, the probability of selecting a unique wealth tax drops, regardless of one’s financial wealth.

Hands off my house

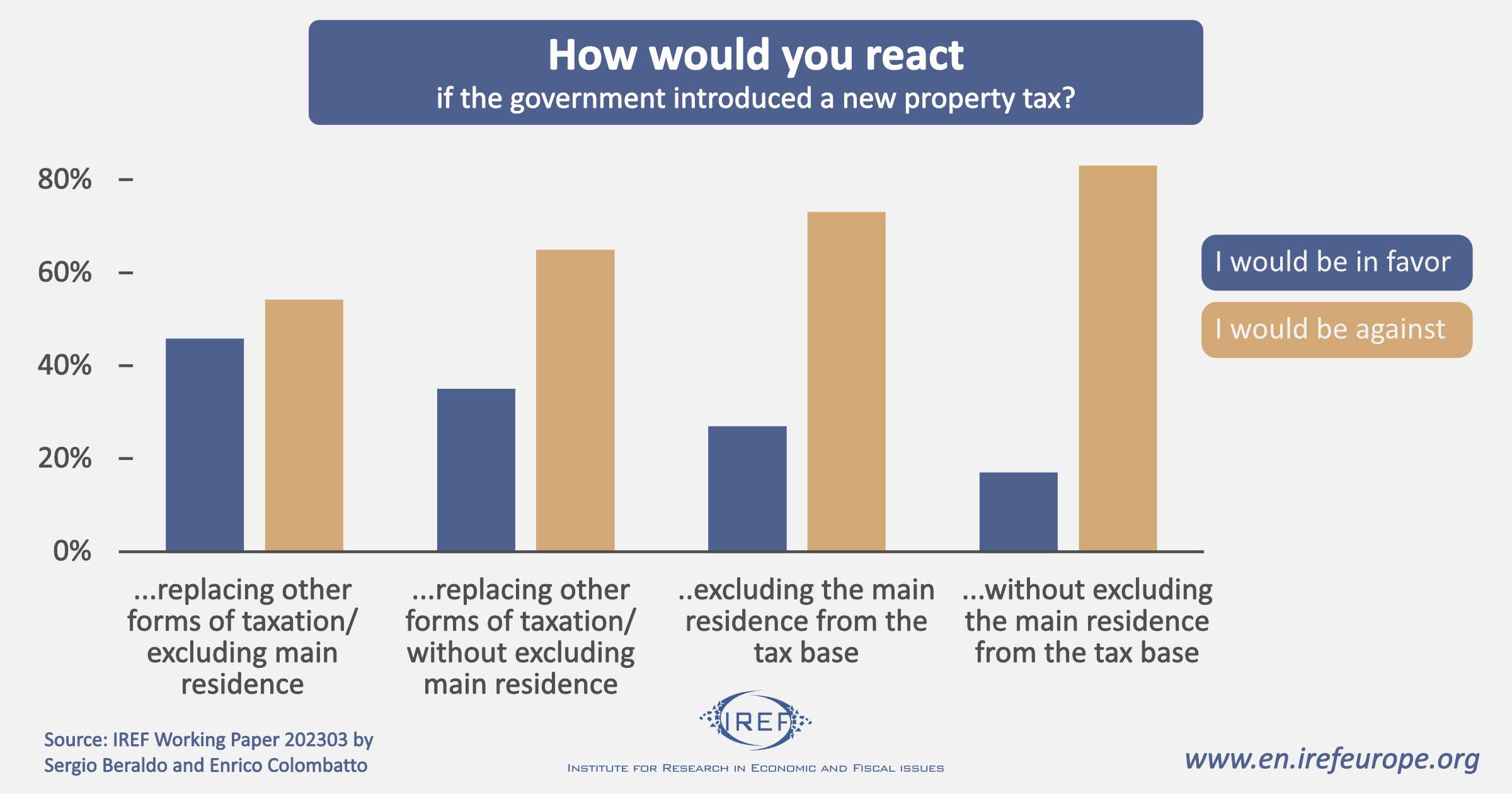

As mentioned earlier, a strong finding of the survey is that support for taxation on wealth is stronger among those who believe that fair taxation means lower taxation. One may thus suppose that a share of those who desire a lower tax burden may still be skeptical about taxing wealth because they may fear that proposals to increase the role of wealth taxes result in heavier overall taxation. To shed some light on this point, the sample of interviewees was split into four subgroups. The interviewers asked all interviewees whether they would favour a new property tax in lieu of other forms of taxation, but each group was given different information on whether the new tax would replace other taxes and on whether the main residence would be excluded from the tax base (Fig 3).

Fig. 3

Once, again, it appears that people do not necessarily oppose the introduction of taxes on wealth. Indeed, 46% of the interviewees are in favour, provided that the tax replaces other forms of taxation and the main residence is excluded from the tax base. However, support drops to 17% when the question fails to mention that the new tax would replace other forms of taxation and that the main residence is excluded from the tax base.

This confirms that Italians do not oppose taxing wealth, and are actually willing to accept a wealth tax in substitution of other forms of taxation. The only major exception regards inheritance: 83% of the interviewees are against a tax on inheritance, which they consider a tax on the dead. This view is also shared also by left-wing oriented individuals.

Since much of the Italians’ wealth is inherited, the message to the policymaker seems clear: inheritance per se should be tax free, but it can be included in the tax base once it becomes part of the beneficiary’s assets. In fact, one may argue that strong opposition to wealth-tax proposals originates from the fact that policymakers frequently insist on taxing inheritance, rather than wealth in general.

As highlighted above, the main source of opposition relates however to tax pressure. Since most Italians believe that its current level is exceedingly high (85.4% of the sample would like a tax pressure less than 40% of GDP and 54.8% would like it to be less than 30% of GDP), and since the Italian public-finance situation is precarious, it is hardly surprising that vague proposals to reform the tax system are perceived as covert attempts to raise pressure.