In the Middle Ages in the Middle East, merchants and travellers would sometimes have a proof of having paid their tax tattooed on their necks, to prove that they don’t have to pay again. Modern EU has devised a less painful alternative – a “Portable Document A1”. It is automatically recognised everywhere – except in Belgium. That’s worse than mediaeval…

The Portable Document A1 allows migrant workers (of whom there are many especially in Belgium, the administrative seat of the EU) to show to the host country that they have paid their social security tax at home and that, therefore, they are not liable for having to pay it again.

A currently valid Belgian law grants local tax offices the power to disregard the document and hold the migrant liable for paying social security tax for a second time. This is wrong for at least three reasons.

1) Belgium engages in illegitimate double-taxation

A normal tax does not create any claim to receive any government services. Just because you have paid your taxes does not give you an automatic legal right to mended potholes on government’s roads or better schools (although it is certainly legitimate to expect those services) Governments make spending decisions, and independently they decide how they will collect the money. Without a one-payment-one-service link, a government can decide to burden anything with a double-tax. Or even a triple-tax. For example, the fruits of an hour’s worth of work are taxed first as income tax, then as sales tax (or VAT) when it is spent and then again as profit tax (when it is received by the producer).

Social security tax, however, is different. It is not strictly a tax since it does give a claim to a government service – namely to unemployment and/or pension benefits. (Unless, of course, the government decides to change the law between the time you’ve paid and the time you want to be paid.) Unless the worker pays this special tax during employment, (s)he will find it difficult to claim money during unemployment. This tax is therefore a kind of compulsory “membership fee” (though unlike in ordinary clubs, the fees are usually not fixed but rise with income). As the worker will only receive one set of support, it is illegitimate to charge them twice.

2) Belgium charges for service it knows it will never deliver.

In some cases, imposing double social security tax may be legitimate. Foreign residents, for example, may be entitled to some benefits once they become unemployed in the host country (as long as they continue to search for work). It may be proper to pay “again” to the government that hands out these benefits. However, the particular Belgian situation involves “migrant workers” who have been sent to Belgium by their employer. Once unemployed, they will no longer be posted in Belgium and the host government will therefore not be “liable” for their unemployment benefits.

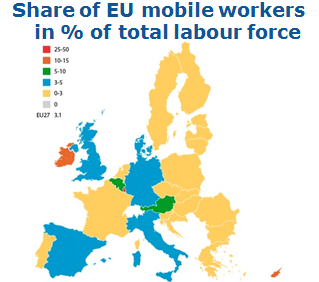

That this opportunistic behaviour is exercised by precisely Belgium may be significant. As the figure demonstrates, it is among the top three attractors of migrant workers in the EU. The high share of migrant workers in Belgium may even be more permanent than in the other two countries. Belgium attracts them with central EU administrative offices, while in Ireland it is a consequence of the now halted boom and Austria’s figure is boosted by many temp jobs in tourism..

3) Belgium undermines faith in EU institutions

Belgium does not double-charge social security automatically, but only once a local tax authority decides not to recognise the “Portable Document A1”. Local tax assessors cannot be expected, of course, to be experts on all 28 different social security systems and might not know whether a migrant is already covered by social security at home.

That’s precisely why the EU has created one standard legal document to demonstrate compliance and dispel any doubts that the foreign authority may still have. Should any still persist, there is even an official dispute resolution mechanism where misgivings can be addressed. But simply not acknowledging the document by the Belgian authorities is like not recognising a country’s passport at the border. Hardly a way of building a free Europe.

Diversity of member states’ social security systems is EU’s strength, not weakness. It enables competition of systems and offers an easier way out of excessively oppressive ones. The EU is currently on route towards trying to standardise and harmonise these systems. It is completely unnecessary; it suffices to standardise and harmonise documents showing good standing to foreign governments.

Fortunately, the European Commission does the right thing here. At the end of March it filed a lawsuit with the European Court of Justice against the Belgian system. The EC should prevail in the lawsuit. Citizens should be given a chance to show that they are in good standing. Denying them this possibility would be equivalent to treating them worse than in the Middle Ages.