The recently updated European Markets in Financial Instruments Directive, commonly abbreviated as MiFID II, is supposed to enhance consumers’ protection. Adjustments of regulatory background questions aside, the EU aims to improve “protection of investors by prohibiting the acceptance of commissions, protecting independent consulting, introducing new regulations regarding product monitoring”. This intention seems laudable, especially given the presence of some black sheep among investment advisors. However, a well-meaning policy is not necessarily also good for consumers. While the providers of financial services now legally safeguard themselves using elaborate documentation, clients do not necessarily receive better guidance. In fact, extensive documentation could possibly scare customers off.

MiFID II – What’s new in financial consulting?

MiFID II has significantly changed retail banking. Advisors are currently required to disclose the prospective costs of securities transactions in detail, including fees and commissions. This enhances transparency and potentially increases competition, leading to lower fees. At the same time, however, the requirements for the advisory process have also increased.

Put simply, the world of investments has experienced a shift in the burden of proof. As in the past, customers must estimate their own attitude towards risk. Now, however, the advisor must check whether the customer’s risk tolerance is appropriate, and ensure that the financial product in question suits his client’s profile. The advisor must analyse not only his client’s financial experience, investment aims and horizon, but also his overall financial situation. This includes calculating his individual ability to take risks. This does not just mean comparing income and expenses. Every aspect that influences the customer’s financial situation and his ability to sustain potential losses, even a pay-tv subscription or the child’s mobile phone contract. Financial advice also includes a suitability record, with reference to which the advisor is held responsible for the products he has recommended and their consistency with the clients’ life situation, plans, experiences and financial context.

All communications regarding transactions in securities must be recorded and stored for 5-7 years. This refers to written correspondence and phone conversations. According to article 16 (7) of the law, this also applies to conversations that lead to no transactions. Face-to-face conversations are exempt, but every security order has to be documented and, if requested, handed out to the customer. Every recommendation will be reported in the suitability record mentioned earlier.

Too much information

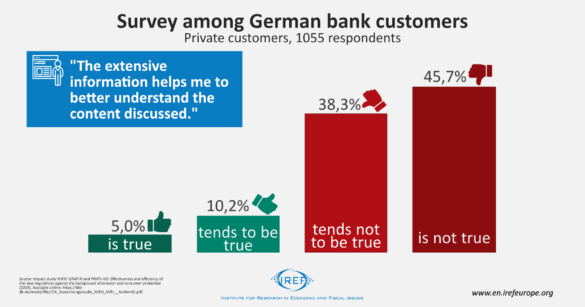

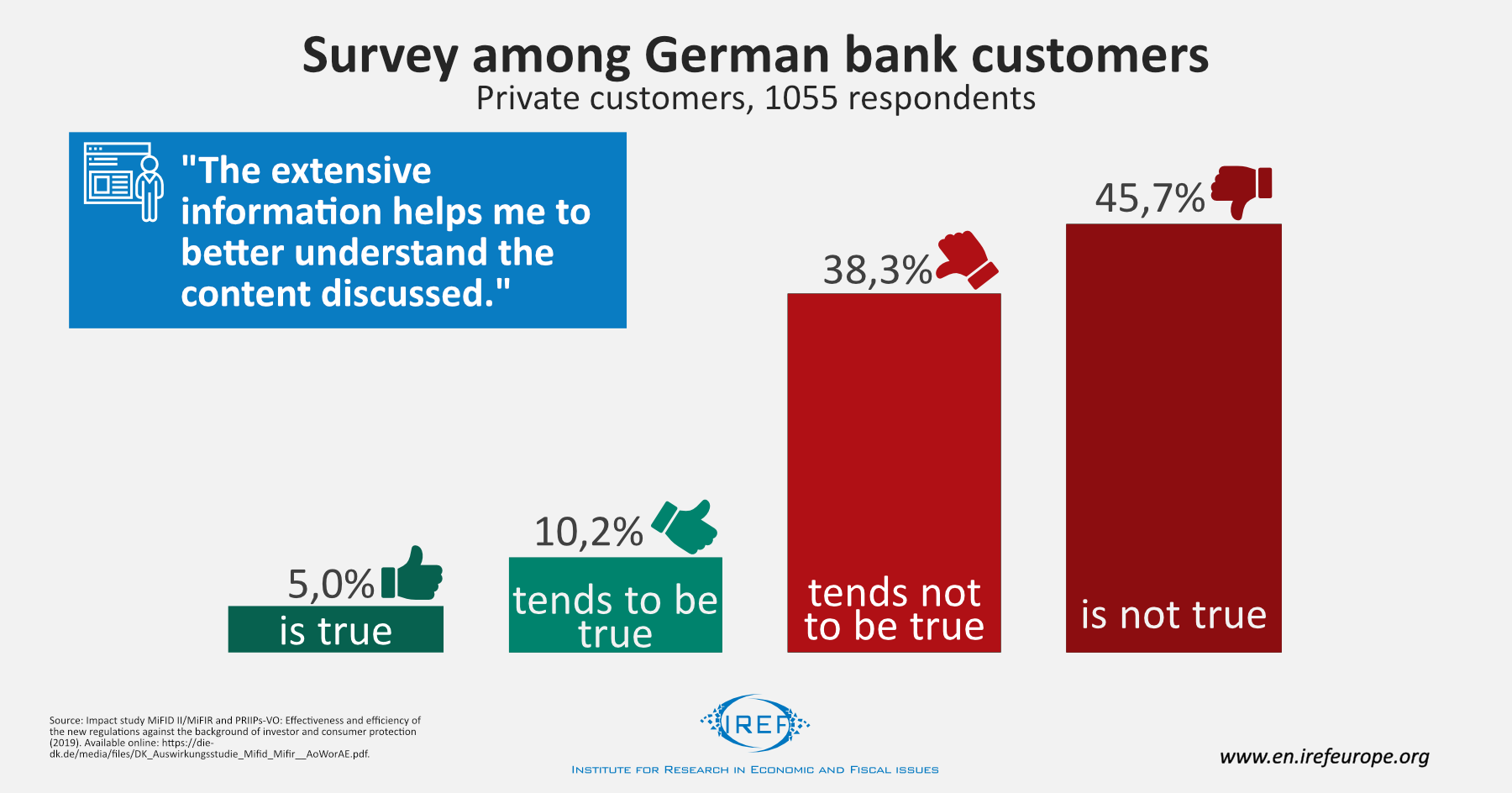

With suitability records, prospectuses and product information leaflets, customers have plenty of information readily available to them. Yet, “the more the better” is not necessarily true.

Behavioural economists call this the “curse of knowledge” or “information overload”. Gerald Spindler (2011) analysed investors’ protection laws and showed that private customers often feel intimidated rather than informed by detailed explanations. The quantity of information overstrains customers, who find it difficult to evaluate quality and likely face emotional barriers when looking into investment projects. MiFID II could have the same effect.

Too much effort

In marketing research, the concept “transaction inconvenience” plays an important role for online shopping. Melek Erdil (2018) collected several studies that mention complicated and cumbersome purchasing processes as a reason why customers abandon online purchases. It is likely that the same applies to banking business. If building an investment portfolio is made more difficult or tedious by MiFID II, it is possible that ceteris paribus more customers stop short of completing the process.

Likewise, customers often have to spend more time in a number of transactions that require physical presence. Deutsche Bank estimates that opening a stock deposit that used to take about 45 minutes now absorbs 90-120 minutes. It is unlikely that clients will leave the office in the middle of a conversation with their advisor. However, a long appointment might be more likely to be cancelled than a short one.

Too much weight on risks

Behavioural economics has revealed that human beings weigh losses higher than gains of equivalent size, that they exhibit a present bias, and that they underestimate the effect of long-term saving, i.e. compound interest.

In light of these phenomena, it is to be expected that MiFID II has a rather discouraging influence on investors, who might miss out on the advantages of forward-looking retirement plans. In this light, one may say that MiFID II adds short-term inconveniences to financial planning, and while the advisory process emphasises possible losses, the underestimated long-term gains further recede in the background.

Costs and reactions from banks

It is not obvious that MiFID is advantageous for consumers. It is certain, however, that MiFID means that banks have to devote more resources, and possibly charge higher fees to their customers.

Banks are also likely to reduce their portfolios, and neglect simple, traditional products like bonds and shares. For example, Direct Bank ING has reacted by cutting its range of products by roughly 80,000 financial products. Other big internet banks have taken similar measures. This means that customers face a smaller set of options, especially if they are reluctant to switch to a different bank. A narrower range of products results in clients’ demands being met with less accuracy. This was surely not intended with the introduction of MiFID II.

Nothing gained, nothing lost?

MiFID II was certainly well-intentioned. Private individuals do not behave like investment experts. This is why customers should be protected when making investments. Apart from disclosure requirements concerning fees and commissions, however, it is not evident that the new rules meet this goal. Additional disclosure obligations and additional documentation do not guarantee better advice and could easily scare – rather than educate — customers.

The stronger the off-putting effect, the higher the risk that MiFID II is doing consumer protection a disservice by reducing the number of consumers. More is not always better – especially when it comes to regulation.