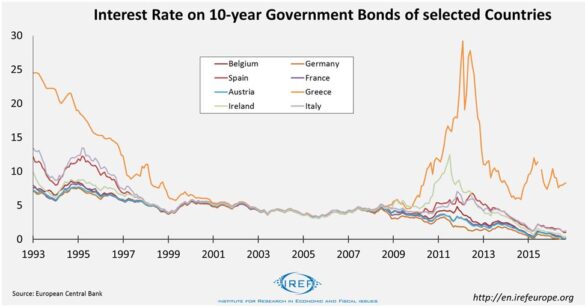

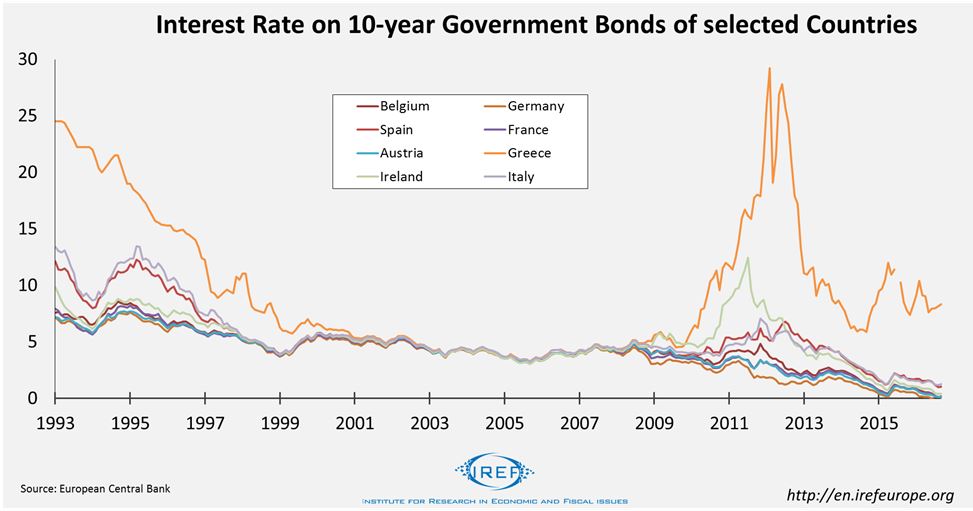

When interest rates on government bonds of struggling countries in the Eurozone rose heavily, up to the summer of 2012, ECB president Mario Draghi announced on 26. July 2012 that “the ECB is ready to do whatever it takes to preserve the euro.” It was the birth of the not yet used OMT program which allows buying an unlimited amount of European government bonds in the secondary markets. The announcement led to an increase in prices of government bonds. Also, banks held these bonds and where therefore indirectly recapitalised, enabling them to increase lending. Instead of lending to profitable firms, however, banks tended to give out loans to unprofitable and essentially non-creditworthy companies. From a superficial perspective, the OMT has helped to calm down financial markets participants, however, when having a closer look it made financing lucrative companies more difficult, hampered investments, and thus weakened growth.

“Whatever it takes”

In June 2012, refinancing costs for Greece, Ireland, Portugal and Spain (GIIPS) peaked. For example, the yield for 10-year Greek government bonds reached 28%. Investors did not just lose their trust in the governments but also in the banks of the GIIPS countries, which held big bond positions of their respective governments and were suffering from their price decreases. Facing weak capitalisations, banks were reluctant to lend especially to small and mid-cap companies.

Mario Draghi’s announcement that the ECB will do “whatever it takes to preserve the euro” and the resolution of the OMT program on 6. September 2012, made government bonds of struggling countries attractive again. Subsequently, market participants regarded the risk of a default as substantially lower. Since the decision market participants assume that the ECB will buy the government bonds of a struggling member state under emergency. The banking system of the Eurozone was thus stabilised in the short-run. Apparently, Draghi’s comments for a short time also improved access to loans for companies in the GIIPS countries.

Artificial Respiration for Zombie Companies

Economist Viral Acharya, from New York University and other authors also find evidence that the ECB’s announcement of the OMT stabilised the European banking sector and that the partially recapitalised banks gave out more loans. But which companies benefited through increased lending from the price increases of government bonds from GIIPS countries? Acharya and his colleagues present convincing evidence that banks were lending more to companies with poor credit-ratings while keeping lending to companies with high creditworthiness constant. According to Acharya and his co-authors, this is to be at least partially blamed on banks which still remained poorly capitalised after the OMT announcement and which had an incentive to lend to so called zombie firms.

Zombie firms are characterised by lacking the ability to repay interest and principle in a timely fashion. Through fresh loans to zombie firms banks can avoid classifying their already existing loans to them as “non-performing” or having to write the loans down. Thus a bank can keep its equity ratio artificially high by giving out loans to insolvent companies and therefore fulfil its capitalisation requirements.

According to the IMF, in 2013 in Portugal, Spain and Italy 50%, 40% and 30% respectively of debt was owed by companies not being able to cover interest payments from their pre-tax profits.

Profitable Companies: Less Investment, less Growth

Evergreening has not just prevented zombie companies in the GIIPS countries from insolvency, but also increased the fraction of such firms in the market. Not just their healthy competitors are suffering from this but also other members of the society. First of all, zombie firms are pushing up demand for loans, hence, increasing interest rates also for profitable companies. Secondly, the inefficient zombie companies are tying up resources which could have been used more efficiently by profitable firms. Investments and employment growth of profitable firms are thus affected by the lending of undercapitalised banks.

Something similar happened during the 1990s in Japan, when a loose monetary policy and bank bail-outs of the Japanese government created more and more zombie companies, as shown by Ricardo Caballero and other economists.

The Destruction of Creative Destruction

Of course, insolvency is not a very pleasant event for the shareholders and employees of unprofitable companies – still, it is a desirable thing for society as a whole. Through their consumption choices, customers tell insolvent firms that they value the usage of resources by other companies more. The wasteful usage of resources by companies is thus reduced to a minimum by a constant process of trial and error.

This process, described by Joseph Schumpeter, is called creative destruction and describes the constant re-combination of production factors, which enables progress and innovation while old and inefficient production structures disappear together with the companies using them.

The financing of zombie firms, which is partially caused by implicit price guarantees of the ECB for government bonds in the Eurozone, slows down this process of creative destruction.

OMT Announcement: Visible and Invisible

The OMT announcement might have stabilised the European banking system. This short term effect was apparent. Also apparent were the avoided dismissals. However, the lost innovations and the missed out (employment) growth which would have been caused by closing down inefficient companies and the stronger growth of more efficient firms remained invisible on the first look. That Draghi’s “Whatever it takes” combined with the announcement of the OMT program hampered the economic upswing after the crisis and still does so to this day, only gets apparent upon closer inspection.

This article is a translation of an original piece published on our German site and available at http://de.irefeurope.org/Seen-and-not-seen-EZB-Geldpolitik-und-Zombie-Firmen,a1187