CO2 emission limits and targets are currently all over the news. For example, the European Union is gradually strengthening the environmental standards for new vehicles, with a view to reducing greenhouse gas emissions by 60% by 2050. These emission targets, however, could be reached more efficiently by extending the successful European emission trade system to the transport industry, and further.

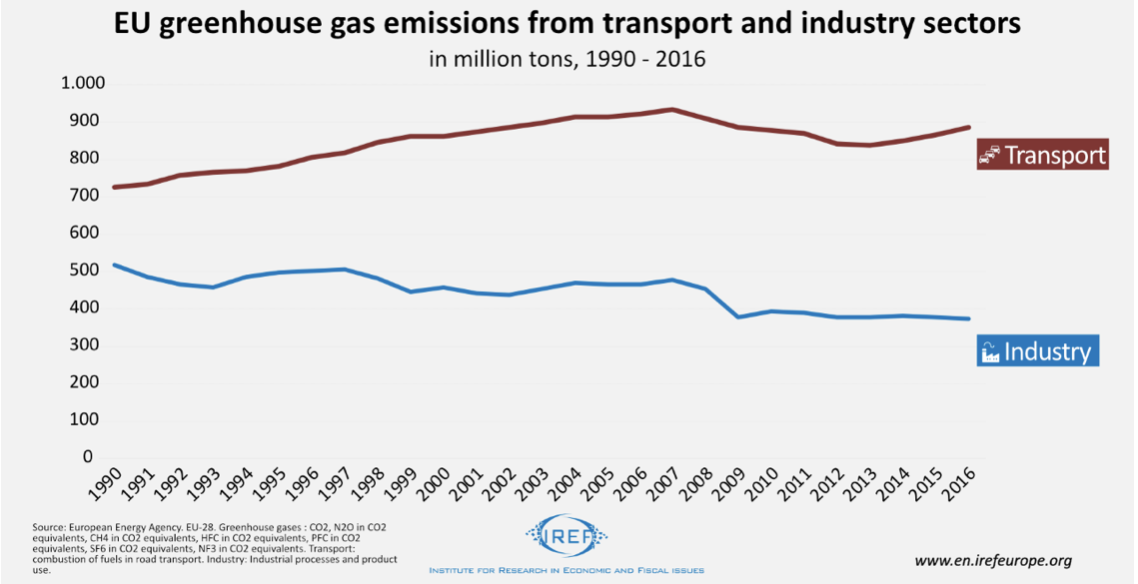

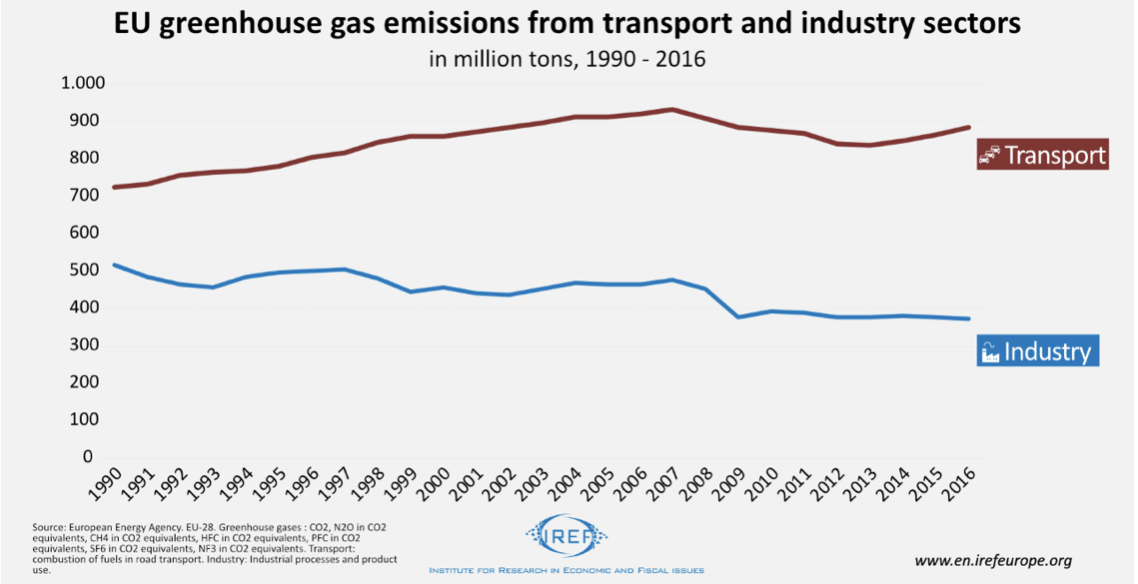

Greenhouse gas emissions caused by burning fuel in road traffic have not decreased since 1990 – in fact, they have increased by 22%. By contrast, over the same period, emissions have decreased in other sectors. Industrial emissions, for instance, have gone down by about 28%. In these cases, the name of the game was not the introduction of emission caps. Rather, since 2005, large parts of energy-intensive industry are involved in the pan-European trade of emission permits.

How do vehicle-specific emission caps work?

Each European manufacturer of vehicles must ensure that new vehicles on average do not exceed the assigned CO2 target. This target includes two components. First, there is a base rate, the so-called fleet fuel consumption target. This identifies the European target for average CO2 emissions of new vehicles. Second, discounts or surcharges are applied. These depend on the average weight of a vehicle compared to the average weight of all the new vehicles of the past years. If a manufacturer’s cars are heavier than the average, they get a higher CO2 allowance. Hence, manufacturers of heavier vehicles are subject to less strict requirements than manufacturers of lighter vehicles.

Emission caps do not guarantee emission reduction

Yet, the emission caps for new vehicles do not guarantee that the EU reduction targets will be met. First, older vehicles emit CO2, and are not affected by the more recent, stricter emission caps. Moreover, caps are defined with regard to the emission per 100 km, but there no limits on how many kilometres a car runs. Thus, emissions can rise if cars are used more frequently — a phenomenon known as the Jevons’ Paradox.

Taxes and tradable permits

If CO2 reduction targets are to be fulfilled, it is insufficient to only consider CO2 emissions per 100 kilometres of new vehicles. Rather, the actual emissions of all vehicles should be in the centre of attention.

Two policy tools could be used in this respect. A fuel tax similar to the energy tax would increase operating costs per driven kilometre and, thereby, encourage consumers to drive less and to demand vehicles that use less fuel. Although this tax is a more reliable tool for the reduction of total emissions than the emissions cap, it still cannot guarantee the achievement of given targets. The tax rate needed to fulfil the desired emissions level is unknown.

On the other hand, tradable permits have the potential to guarantee a set level of emissions. While caps and taxes can only be successful when set at the right level, tradable permits only require knowledge of the overall amount of CO2 that shall be emitted. Within this framework, emissions of CO2 are allowed only if matched by the purchase of a permit. Since the total number of CO2 permits is fixed, higher demand for fuel would not raise emissions, but rather the price of the permits.

Less effort, less CO2

The permit solution would not only guarantee the level of emissions, but would also do it efficiently, i.e. where the reduction is the least expensive. If those affected have to buy permits for emitting exhaust gases, they have to consider whether it is preferable to buy a permit and emit, or whether it is cheaper to avoid emissions altogether. It follows that those who do buy a permit are those who would face a higher costs if they had to reduce emissions – and vice versa.

Using ETS trade

The amount of yearly available permits can be reduced gradually. For example, the European Emissions Trading System (ETS) provides for a yearly 1.74% cut in the number of permits decreases until the end of next year. From 2021, the yearly reduction will rise to 2%.

The transport sector could be integrated into the already existing emissions trade system if refineries and fuel importers had to buy permits for the fuel they sell. Drivers would not have to deal with buying permits. Permit prices would influence fuel prices, and influence drivers’ behaviour as a result. In return, motor vehicle taxes and energy taxes could be scrapped.

Extending emissions permits

As mentioned earlier, emission caps for new vehicles have not yet managed to reach the aims of the EU. Tightening up the limits for new vehicles will certainly increase the costs of running such vehicles, but it is questionable whether they are able to help achieving the planned CO2 reduction. We have pointed out that a more promising alternative is available. Defining and trading emission permits could help reach the desired targets, and do so efficiently. Sectors in which emissions caps and rules currently prevail could also be included into the permit-trading system. For example, reducing the heating in the building could become cheaper than, say, insulating them.