As we recently pointed out, the UK Chancellor of the Exchequer, Mr Phillip Hammond, was left aside by the Conservative party during the last campaign for parliamentary elections. With him, economic issues and detailed plans regarding Britain after Brexit were also largely neglected. After the disappointing and rather embarrassing performance of the PM Theresa May in the elections, a critical Mr Hammond seems now ready to re-establish his position within the Party and the Government. What will be the effects on the Brexit talks and the economic performance of the country?

Austerity and UK Productivity

It is traditional in June for the UK Chancellor of the Exchequer to give the Mansion House Speech on the state of the British economy. This year, due to terrorist attacks and the fire accident at the Grenfell Tower, the speech has been postponed to the 20th of June. These events have also turned the focus of the political and public finance debate in UK on austerity and on the alleged lack of resources available to police and emergency services.

In spite of various calls for a softening of austerity, the Chancellor argued that only an increase in labour and business productivity would allow the government to increase spending (increases in taxation and/or borrowing would be instead unwise and, essentially, against the Conservative Manifesto). Specifically, he said:

…so we will remain committed to the fiscal rules set out at the Autumn Statement which will guide us, via interim targets in 2020, to a balanced budget by the middle of the next decade.

The issue of low UK productivity is well-known. Recent Governments have attempted to tackle the problem, but unsuccessfully.

Mr Hammond explained that the government was committed to increase skills and productivity of the workforce and firms. But how? He particularly focused on the importance of attracting investments.

One of my immediate priorities is making sure government is doing all it can to facilitate access for firms, large and small, to capital, to allow them to grow and bear the fruits of the flow of innovation that is pouring out of UK universities.

Interestingly, given the current Brexit talks, Mr Hammond explicitly mentioned the role and importance of the European Investment Bank, EIB.

In the long-term, it may be mutually beneficial to maintain a relationship between the UK and the EIB after we leave the EU.

We recognise the role that investments play in an economy, but it is unclear from the Chancellor’s speech how a country affected by low productivity can actually become more attractive to investments. The availability of funds is not a sufficient condition to ensure efficiency and growth. The country clearly needs a comprehensive plan that would entail reforms in education, welfare state and unemployment benefits, social care, etc. It is also imperative that its relationship with the rest of Europe becomes clearer as soon as possible.

Interestingly, the Chancellor’s view on globalisation and the central role of liberalisations was more inspired.

[…] we must push for a new phase of globalisation, to ensure that it delivers clear benefits for ordinary working people in developed economies. […] for the UK to be able to share fairly in the benefits of globalisation, we need to lead a global crusade for liberalisation of services.

Brexit and Migration

Mr Hammond’s stance on Brexit should be inferred from the statements released during his interview on the Andrew Marr show and through the recent Mansion House Speech.

Stating that it is time to put “the economy first”, Mr Hammond outlined a “soft” approach to Brexit. Essentially, the Chancellor advocates a “transitional arrangement” where the UK keeps a close relationship to the single market and, possibly, the customs union, while progressively modifying its laws and institutions. It is, however, unclear at what point this transition should precisely end.

Mr Hammond’s view on a soft Brexit, certainly, raises some political issues internal to his Party. Membership to a free-trade single market would not allow the UK to impose its own immigration laws. Immigration, however, was a particularly critical issue at the heart of the Leave campaign. It is likely that Mr Hammond’s vision of the UK outside of the EU may find fierce opposition within the Conservative Party. Negotiations parallel to those in Brussels are quite likely taking place now in number 10 Downing Street and a leadership contest within the Conservative Party may be round the corner. This situation, created by miscalculations and inept management of the election campaign, is obviously far from ideal for the UK.

An uncertain start to Brexit negotiations

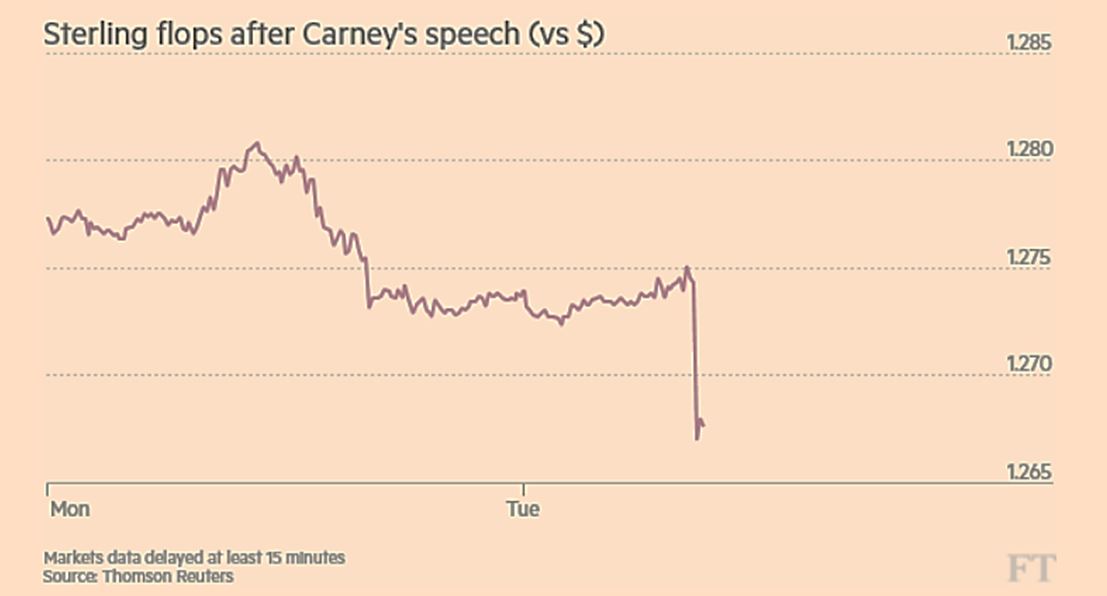

There was another speaker at The Mansion House: Mark Carney, the Governor of the Bank of England. The Governor told the audience that due to a general weakness in the UK economy and widespread uncertainty regarding Brexit talks, he was dismissing the possibility to raise interest rates. The markets immediately picked on the Governor’s lack of confidence in UK economy and the pound registered a fall with respect to the dollar.

The upshot is that the Chancellor’s speech in favour of a softer Brexit and the Governor’s severe look at the UK economy (together with a weakened PM and a number of new Cabinet members that used to belong to the Remain campaign) considerably weaken the negotiating position of the Brexit Secretary, Mr David Davis. Given the division within the Conservative Party and the lack of a comprehensive plan of reforms, it is indeed very difficult for us to foresee a positive outcome of Brexit and a healthier UK economy for the next couple of years.