The Swiss National Bank (SNB) has recently published a record profit of staggering 54 bn. Franken or €46 bn. The central bank´s profit is equivalent to 6,600 Franken for every Swiss citizen. In a market economy, profits are the sign of successful economic action. Does this mean that the Swiss should celebrate the central bank´s performance and praise their savvy central bankers?

As a matter of fact, what looks like a great investment record is rather the result of a desperate move. For years, the SNB has been buying foreign securities with newly produced Franken in order to weaken its own currency to the benefit of Swiss exporters. By contrast, Swiss consumers paid the bill. At the end of 2017, products and services bought within the Eurozone were up to 9 percent more expensive than at the beginning of the year for the Swiss. In a sense, the SNB is subsidizing the Swiss export industry at the expense of Swiss importers and consumers.

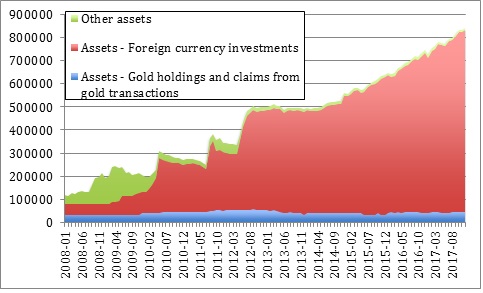

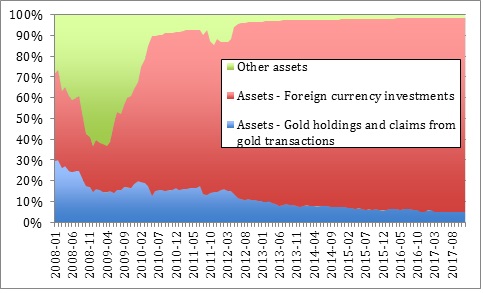

Today, the SNB´s foreign-currency denominated assets amount to 790bn Franken, 94 percent of its total assets, while the balance sheet total amounts to 122 percent of Swiss GDP, which is a world record. Holding a large amount of currency reserves implies that changes in foreign exchange rates affect book values in the SNB balance sheet massively. When the Swiss Franken weakens against the Euro, the Euro denominated assets of the SNB rise in value (in terms of Franken). Thus, as the Franken lost in 2017 8.7 percent against the Euro, the SNB recorded enormous accounting profits. In the same year, the SNB´s gold reserves also appreciated in terms of Swiss Franken (by some 8.2 percent), and the same applies to the value of the stocks in its portfolio; Microsoft, Apple, Amazon, Facebook and Starbucks.

When evaluating the profit and balance sheet of a central bank one has to consider that the accounting concepts of the private economy fail to have the same meaning for central banks. The profit of a central bank is not the same as the profit of a private company in a market economy. While private companies thrive only if they satisfy consumers and beat their competitors, a central bank has few costs and no competitors in its territory.

Moreover, we must analyze the equity of a central bank´s balance sheet with caution. A central bank can become balance-sheet insolvent when its debts are higher than its assets. Yet, in contrast to private companies, when a central bank is balance-sheet insolvent, its operations do not come to a halt. A central bank can simply ignore its balance-sheet insolvency and continue to print its currency to pay its bills.

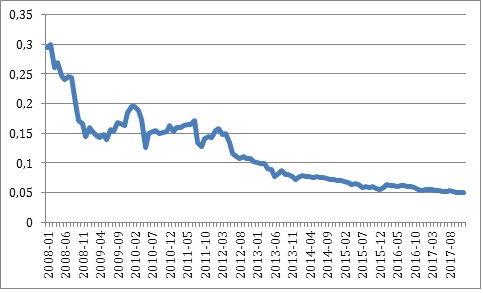

Yet, the evolution of a central bank´s balance sheet is vital in one sense. It indicates the quality of a currency. As a matter of fact, and despite the façade provided by the record profits, the quality of the SNB´s balance sheet has deteriorated dramatically. The gold ratio, i.e. the ratio of its gold reserves to the total assets, has fallen while the weight of stocks and bonds has increased. For example, this makes the Bank vulnerable to future rises in interest rates, which may lead to a sharp fall in the price of bonds depending on their maturity. The same would happen if the euro depreciated. Even the accounting profits of the stock packages may trickle away quickly, should the stock market bubble burst.

More generally, one wonders whether the SNB should compromise the quality of the Franken by speculating on the stock and bond markets.

Moreover, the SNB pays a portion (2 bn. Franken) of its profit to the Swiss Federal Government and the Cantons. The profit distribution decapitalizes the SNB and weakens the substance of its currency as the profit distribution transfers values from the SNB balance sheet to the politicians. The accounting profits can quickly turn into losses once interest rates rise, bond or stock markets dive or the euro depreciates. When these losses materialize the SNB would urgently need the substance it is now distributing.

As mentioned above, the SNB profits are not distributed to the Swiss residents but to the Swiss politicians. Politicians will spend the money and, by doing so, they withdraw resources from the private economy or distort competition with subsidies. Moreover, the 54 bn. Franken profit awakens politicians´ desire for more distribution, which would create even more problems.

In sum, the profit of the SNB is no cause for joy, since in fact such profit mirrors the weakness of the currency. It results from risky investments and export subsidies. Put differently, the presence of profits witnesses to the deterioration and risks in the SNB´s balance sheet. The deterioration of its balance sheet comes in dangerous times. The Euro´s problems are far from being solved and the ECB continues its policy of artificially low interest rates and quantitative easing. Instead of following the ECB´s path and weakening the Swiss currency, the SNB should prepare its balance sheet for harder times to come. It should increase the portion of high quality and liquid assets such as gold and reduce its holdings of foreign denominated high-risk assets.