Speculative bubbles are not the product of irrational behaviour, as many tend to believe. When the price increase of given sets of goods or assets (bitcoins, tulip bulbs, houses, stocks) is driven by the expectation of further growth, there is an incentive to purchase those goods or assets. It is the anticipation of further price increases that causes the rise. Purchases do the rest; they make the prophecy come true, and prices do rise. This mechanism can go on for quite a while. Not indefinitely, however; normally, expectations change at a certain point, also for apparently negligible reasons. When people suspect that prices are too high and are about to drop, they begin to sell, and prices do drop. Those who bought at a very high price and are not quick enough to sell may suffer heavy losses.

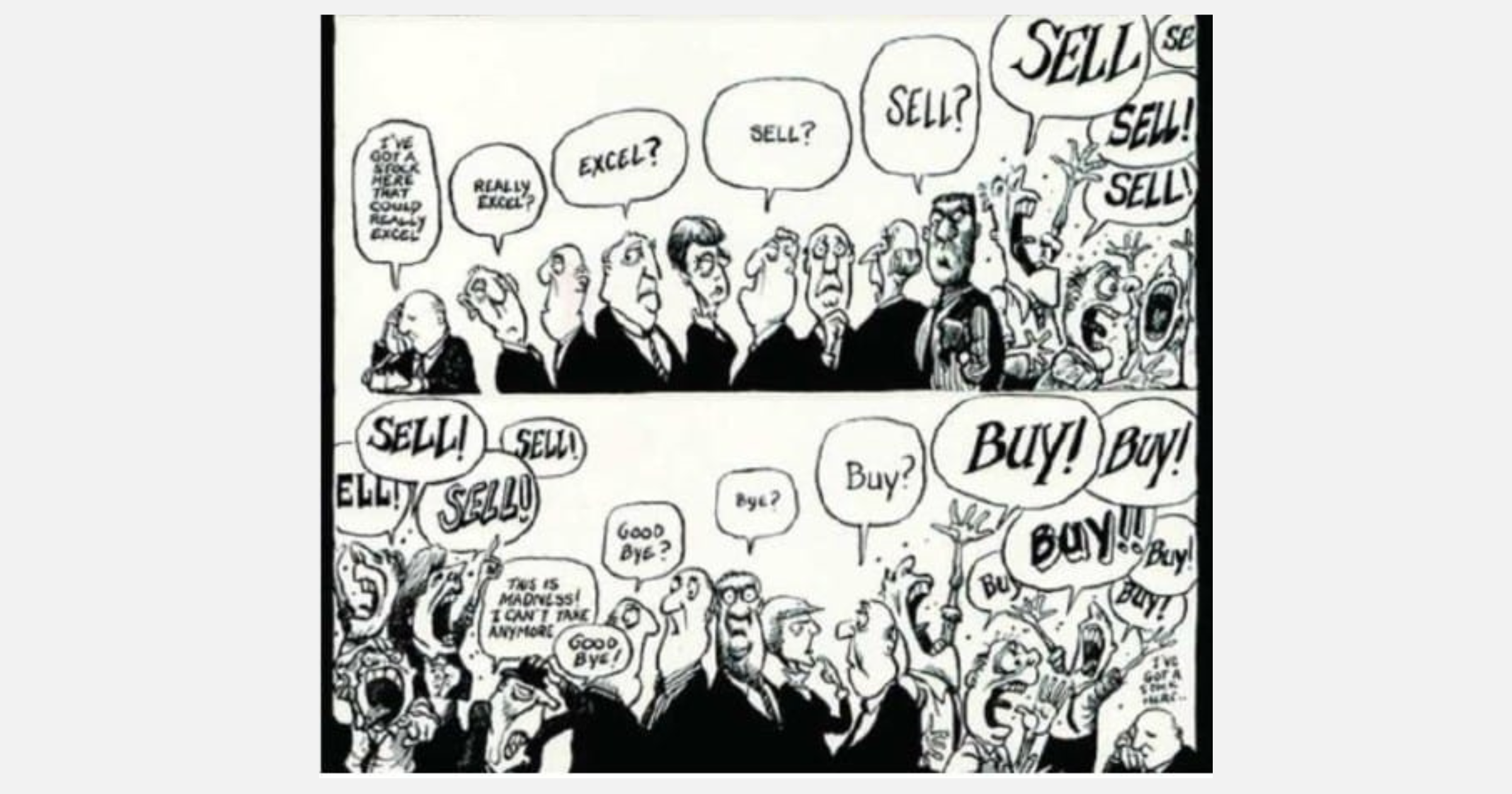

Denying irrationality as the fuel for bubbles is important. If we accepted that behaviour irrationally follows the herd, then we should accept that individuals are not responsible for their actions.

However, that the expectation of persisting rising prices may be based on bad information or false perception of market trends and that naivety or overconfidence may play a role in fuelling bubbles.

Fig 1. Herd Behaviour.

Source: The economist, cover, November 1st 1997.

Tulipmania

A well-known bubble occurred in the 17th century in the Netherlands and concerned the price of tulip bulbs (Garber Peter M., 1989, “Tulipmania”, Journal of Political Economy, 97(3), 535-560). This is a very instructive story to understand the forces behind a bubble.

Tulip bulbs are similar to sturdy onions. They can remain out of the ground for a long time. When planted, tulips give rise to a miraculous multiplication. From the mother bulb, little offspring bulbs sprout, and these can be extracted and planted at a due time.

When the tulip, the flower of God, arrived from Turkey, Europeans were enchanted and rushed to buy them. Prices went through the roof. The Semper Augustus bulb, a white flower with crimson-red streaks, was worth two hundred fat pigs. In 1633, a house located in the city of Hoorn, in northern Netherlands, was exchanged for a single bulb.

Such was the yearning for bulbs that buyers began to purchase those that had not yet sprouted from the mother bulb and therefore were not yet in the possession of the sellers. This was made possible by writing contracts specifying the delivery of a certain number of bulbs on a future date at a price set at the time of the contract. These were early examples of futures contracts, but also early examples of derivatives, which began to be traded regardless of the intention to buy the actual bulbs. In the presence of expectations for rising bulb prices, investors with sufficient resources tried hard to secure rights to future bulbs. Even those without enough liquid funds shared the same interest, and borrowed money to finance their purchases, confident they would be able to pay back the loan thanks to the profits.

Clearly, the value of derivatives depends on the market price of the bulbs. If the price increases, people can sell the derivative at a profit. But if prices are expected to fall, the price of the derivative will also fall. When the market crashes, the victims are not only the tulip traders, but also those who bought – and possibly went into debt — tulip-related derivatives.

This is what happened when a tulip bulb auction in Haarlem went empty: panic spread throughout the Netherlands, resulting in an uncontrollable rush to sell. Prices dropped sharply. A very similar sequence of events repeated itself almost four hundred years later with the subprime mortgage crisis in 2007/2008.

Conclusion

One would be tempted to argue that only market actors are responsible for the swelling and then bursting of a bubble. In fact, bubbles are very often triggered by regulation. In the case of the US sub-prime mortgage crisis (2007-2008), the real estate bubble was inflated by a particularly generous monetary policy coupled with the US authorities’ stated goal of guaranteeing a house to every citizen. Sub-prime mortgages – i.e. mortgages granted to people often having no income, job or other assets to show up as collateral – fuelled market price expectations and created a formidable moral hazard problem. Banks tried to get rid of these bad loans as quickly as possible by transforming them into securities and then selling them to the market. Financial institutions were happy to buy mortgage-backed securities: real estate prices were on the rise and they seemed to guarantee significant profits with limited risks (the houses were a safe collateral). When expectations about prices changed, however, sub-prime borrowers preferred to leave their houses to the banks rather than repaying their mortgages. In turn, banks did not want to be burdened by too much real estate and tried to sell, thereby accelerating the price drop. Not surprisingly, financial institutions owning mortgage-backed securities all over the world experienced severe capital losses.

Bad regulation is also fuelling the current financial crisis in China, which risks to spread worldwide. The real estate sector is a vital part of the Chinese economy, and the supply of land, which is the primary input for real estate development, is controlled by the government. Local governments use revenue from land sales to fund infrastructure and urban development projects. Real estate companies use land holdings and unsold real estate properties as collateral to finance ongoing projects. In a dirigiste economy like China, local officials try to meet the growth targets set by the central government by stimulating real estate investments even if there is really no need for them. Real estate developers follow these policies because they believe that the government will come to the rescue if property prices collapse.

Panic can set in, however, when buildings remain unsold and market participants start having doubts about the government’s ability to sustain prices. This is what is happening in these very months. Banks and real estate companies that directly or indirectly invested in the Chinese real estate market are in trouble. Evergrande seeked protection under Chapter 15 of the U.S. bankruptcy code, while Country Garden Real Estate Group, has recently warned it is anticipating a net loss of billions of dollars. The risk of contagion is real.