Although the global economic performance shows signs of improvement, growth remains fragile. Certainly, lower energy costs contribute to slowing down the rise in prices and this is good news for households and business. In the G20 economies, annual consumer price inflation is expected to decrease from 7.8% in 2022 to 6.1% in 2023 and further to 4.7% in 2024. This trend will be propelled by reduced retail prices for energy and food, as well as diminishing demand pressures and less problematic supply bottlenecks. Uncertainties, however, remain. Despite the tightening of monetary policy, core inflation – energy and food prices are excluded from the index – is expected to remain stable until the end of 2024.

In general, prices and GDP dynamics will be very much affected by the evolution of the conflict in Ukraine and by the trajectory taken by the Chinese economy. On one side, China’s swifter-than-anticipated full reopening might inject momentum into worldwide activity. On the other side, however, its recent real estate crisis might totally change the scenario for the worse.

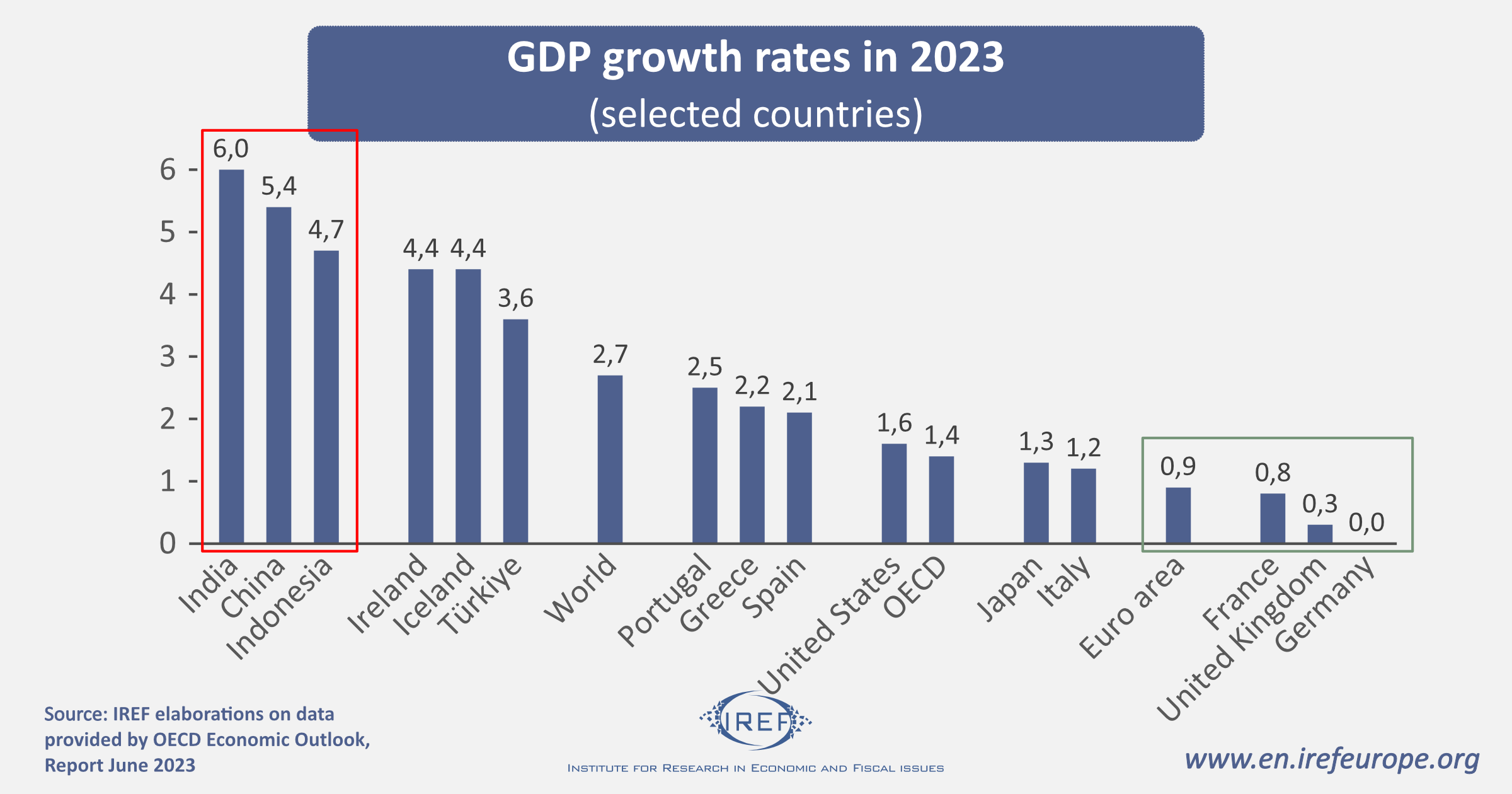

In the most favourable scenario, GDP growth is expected to decline worldwide from 3.3% in 2022 to 2.7% in 2023, and then tick up to 2.9% in 2024. With the exception of the COVID year (2020), 2.7% is the lowest annual rate since the global financial crisis.

In 2023 Asia pulls worldwide GDP growth

Beside China’s real estate crunch, there is a number of other circumstances that justify worries. First, central banks are likely to maintain high interest rates, and many governments are inclined to adopt tighter fiscal policies in order not to rein in public indebtedness.

Tighter credit will discourage investments, which is expected to remain nearly stagnant in the OECD area in 2023. Investments may be further discouraged if governments raised capital and income taxation in an attempt to keep public deficits under control.

In 2023, the relatively modest GDP growth observed worldwide will be sustained by steady increments in private consumption and government final expenditures, with the former being supported by ongoing, albeit modest, reductions in saving ratios.

As depicted in Figure 1, the predominant source of global growth in 2023 is expected to be Asia, with a notable contribution from India (which is projected to retain the highest GDP growth rate even in 2024) and China. China is set to experience the most significant positive growth shift between 2022 and 2023 among G20 economies (from 3% to 5.4%), primarily due to the relaxation of the government’s zero-COVID policy.

Although the real estate crunch in China will have an impact, it is hard to evaluate its effects; nor is it possible to say how the bad news coming from China will condition worldwide economic activity. Some observers fear that a financial crisis similar to that of 2008 could erupt. There is however much consensus about one key fact: the Chinese miraculous growth has come, at least temporarily, to an end, possibly as a result of a switch of its economic model from a market oriented to a heavily centralized one. Indeed, projections show that China’s GDP growth will follow a decreasing trend until 2028 (e.g. https://www.statista.com/statistics/263616/gross-domestic-product-gdp-growth-rate-in-china/).

Indonesia is also expected to register a good performance throughout 2023-24, driven by robust business and consumer confidence, as well as increased international tourism from China.

Fig. 1

The prevailing scenario shows that the Western economies – and Europe in particular – have suffered from the conflict in Ukraine which has led to higher energy costs and increased uncertainty. Countries such as Finland and Poland, geographically closer to the conflict area, are exhibiting sharp falls in their GDP growth rate between 2022 and 2023 (from 2.14% to -0.02 and from 5.43 to 0.89, respectively).

Growth and inflation trends for the United Kingdom follow a similar pattern. Projections indicate a GDP growth of 0.3% in 2023 and 1% in 2024.

A further threat to worldwide growth

The dynamics of global trade and investment are undergoing significant changes. Factors such as the COVID-19 pandemic and the conflict in Ukraine have drawn attention to vulnerable global supply chains.

Moreover, the evolution of the US-China trade relations and of worldwide non-tariffs barriers do not bode well for world trade. The volume of global merchandise imports facing restrictions has steadily increased since the global financial crisis, including those on key raw materials and food products. Such restrictions could lead importers to switch to less efficient suppliers with fewer trade barriers. Higher costs and lower trade volumes will follow. Overall, countries might become less open to trade over time, which could negatively affect growth.

Following the introduction of new bilateral tariffs on Chinese exports by the United States in 2018, China’s portion of manufactured imports in the United States decreased from 25% to 19% by 2022. It is very difficult to predict what will come next, as Xi Jinping returns to State Socialism and Joe Biden strives to isolate the Chinese Dragon.

It is noticeable, however, that, differently from US, the proportion of EU imports of manufactured goods from China has consistently increased, from 26% in 2018 to 33% in 2022. China’s contribution to EU imports has been progressively expanding across most industries, especially in electrical machinery, road vehicles, and chemical products.

This trend may change. The future positioning of China (and India) in regard to the Ukrainian and Taiwanese dossiers will definitely play a key role in shaping trade policies.